Gains and losses under futures taxes follow the 6040 rule. Our broker firm deals mainly in foreign currency trading forex.

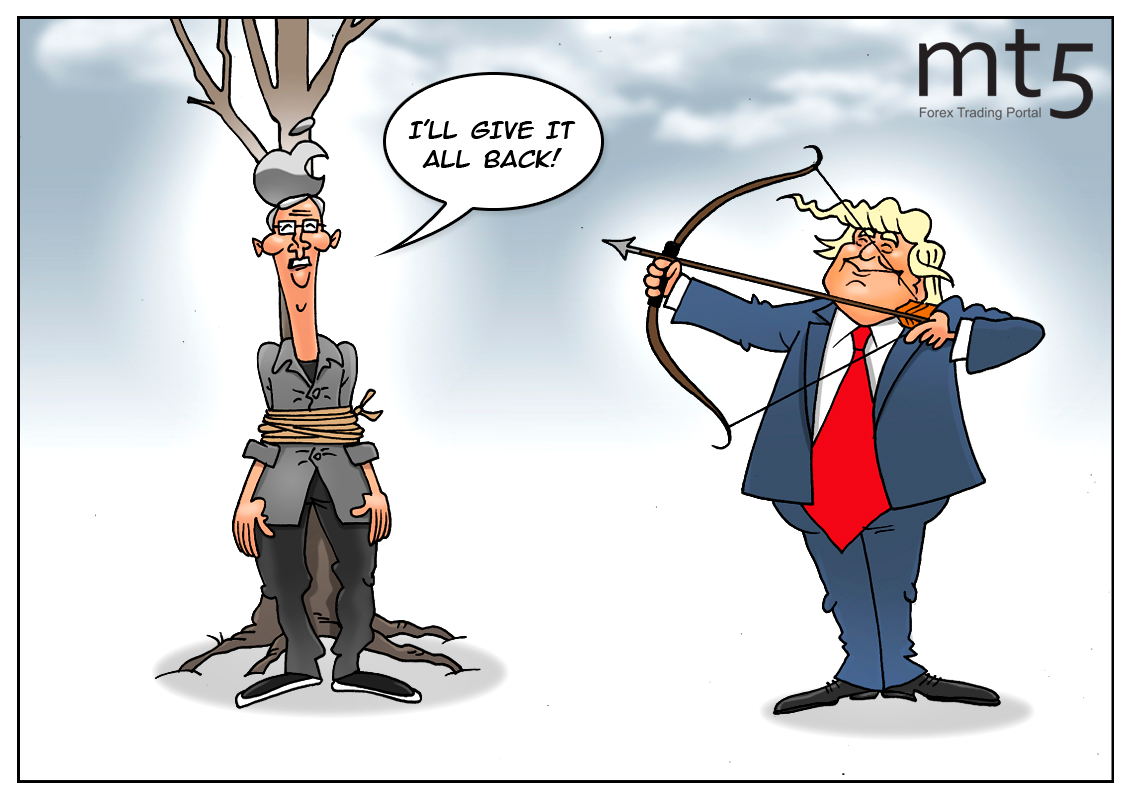

Mt5 Com Us Tax Reform Prompts Apple To Repatriate Overseas Cash

Mt5 Com Us Tax Reform Prompts Apple To Repatriate Overseas Cash

We do not accept clients who are residents of cuba nigeria usa lebanon north korea iran iraq and afghanistan.

Forex taxes in us. In fact the term forex taxes is conditional there is still no law in tax legislation to pay taxes on activities in the world foreign exchange market. The above information on ! the tax implications of trading forex only applies to us based currency traders who have their accounts at a us brokerage firm thats a member of the nfa and registered with the cftc. One of the main questions that you now need to answer yourself is whether you will pay forex taxes.

Day trading live stock market news stocks to trade now. Cash forex is also the wild west when it comes to taxes and reporting trading gains and losses. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary.

Going for a million july stocks stock market live 796 watching live now. Dear sirmadame i am from switzerland. Federal tax state tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 201920 rates.

Some traders try to beat the system and dont pay taxes on their forex trades. 1. The rate that you will pay on your gains will ! depend on your income.

Day trading optio! ns and forex taxes in the us therefore are usually pretty similar to stock taxes for example. 60 of the. In the united states there are a few options for forex trader.

Pay what you owe. We are asking here only for us citizens. Having said that there remain some asset specific rules to take note of.

Do they have to pay taxes on the profits earned from forex. That will give you more time to trade and less time to prepare your taxes. There should be no 1099 reporting for cash forex so you are your own sheriff when it comes to rounding up the gain and loss numbers and paying your taxes with the nuances of irc 988.

First of all the explosion of the retail forex market has caused the irs to fall behind the curve in many ways so the current rules that are in place concerning forex tax reporting could change any time. The so darn easy forex movement help thousands of forex traders from all across the world achieve ex! traordinary results in long term and short term trades. In regards to your question about the us tax rules.

Filing taxes on forex profits and losses can be a bit confusing for new traders. There are us and many foreign private clients posing us these question. So you have decided to become or have already become a trader or investors in the foreign exchange market.

Forex Investors Should Opt For Diversified Equity Funds With

Forex Investors Should Opt For Diversified Equity Funds With

Thread By Realbrianwatt Tax Question Came In Brian I Live In

Thread By Realbrianwatt Tax Question Came In Brian I Live In

Ftw Online Zimra Insists Traders Pay Tax In Forex

Effective Corporate Tax Rate Gold Stocks Forex

Effective Corporate Tax Rate Gold Stocks Forex

Us Stock Options Tax Get The Most Out Of Employee Stock Options

Irs Plans To Situation Steerage On Digital Forex Taxation Ico

Irs Plans To Situation Steerage On Digital Forex Taxation Ico

Taxes On Trading Income In The Us Tax Rate Info For Forex Or Day

Taxes On Trading Income In The Us Tax Rate Info For Forex Or Day

Forex Taxes Irs How To Report Forex Profits Losses Finance Zacks

Yellen S Hint Tax Plan Us Fed Trading Dollar On Eurusd Gbpusd

Yellen S Hint Tax Plan Us Fed Trading Dollar On Eurusd Gbpusd

Tax On Forex Trading In Uk

Solved Let E Be The Direct Exchange Rate For Foreign Exch

Solved Let E Be The Direct Exchange Rate For Foreign Exch

Dax Should Eu Investors Worry About Us Tax Reform Uncertainty

Dax Should Eu Investors Worry About Us Tax Reform Uncertainty

Foreign Currency Trading Taxation Office News Fountain Gate

Forex Irs How To Make 100 Pips A Day In Forex

0 Response to "Forex Taxes In Us"

Posting Komentar